✅ In trading and market analysis, terms like long buildup | long unwinding | short buildup refer to specific market behaviors related to the positions traders take on assets, typically in the context of derivatives like futures and options. Here’s a breakdown of each term:

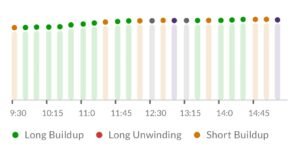

➡️ 1. Long Buildup

– Definition: A long buildup occurs when traders are increasingly buying into a stock or asset, indicating a bullish sentiment. It is characterized by rising open interest along with an increase in the price of the asset.

– Implications: This suggests that more traders are entering positions expecting the price to rise. It can indicate confidence in upward price movement.

– Example: If a stock’s price rises and open interest increases, this may signify a long buildup as traders are accumulating positions in anticipation of further price gains.

➡️ 2. Long Unwinding

– Definition: Long unwinding happens when traders start closing their long positions, often leading to a decline in the asset’s price. It is characterized by decreasing open interest along with a falling price.

– Implications: This indicates that traders may be taking profits or cutting losses, suggesting a bearish sentiment or uncertainty about future price increases.

– Example: If a stock’s price starts to fall and open interest decreases, this indicates long unwinding, as traders are selling their positions.

➡️ 3. Short Buildup

– Definition: A short buildup occurs when traders are increasingly taking short positions, expecting the asset’s price to decline. This is characterized by rising open interest while the price may be stable or declining.

– Implications: This suggests a bearish sentiment among traders, who are betting on the asset’s price falling.

– Example: If a stock’s price is stable or dropping and open interest increases, this may signify a short buildup, indicating that more traders are entering short positions.

➡️ Conclusion

Understanding these terms helps traders assess market sentiment and make informed decisions about entering or exiting positions. Long buildup indicates optimism, while long unwinding and short buildup suggest caution or negative sentiment among investors.

🟢 www.aasthafintech.com